Drawing by Nathaniel St. Clair

One year ago, the Institute for Policy Studies published “Billionaire Bonanza 2020: Wealth Windfalls, Tumbling Taxes and Pandemic Profiteers,” and began tracking billionaire wealth gains as unemployment surged. We teamed up with Americans for Tax Fairness (ATF) to track the wealth growth of America’s billionaires over the last year. This report summarizes the extraordinary growth in wealth of those now 657 billionaires based on real-time data from Forbes on March 18, 2021.

Here are highlights from the last 12 months of billionaire wealth growth:

+ The combined wealth of the nation’s 657 billionaires increased more than $1.3 trillion, or 44.6 percent, since the pandemic lockdowns began. [See Master Table] Over those same 12 months, more than 29 million Americans contracted the virus and more than 535,000 died from it. As billionaire wealth soared over, almost 80 million lost work between March 21, 2020, and Feb. 20, 2021, and 18 million were collecting unemployment on Feb. 27, 2021

+ There are 43 newly minted billionaires since the beginning of the pandemic, when there were 614. A number of new billionaires joined the list after initial public offerings (IPOs) of stock in companies such as Airbnb, DoorDash, and Snowflake.

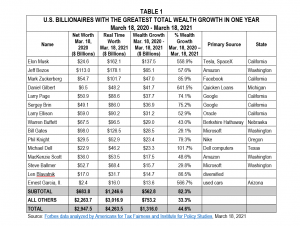

+ The increase in the combined wealth of the 15 billionaires with the greatest growth in absolute wealth was $563 billion or 82 percent. [See table 1] The wealth growth of just these 15 represents over 40 percent of the wealth growth among all billionaires. Topping the list are Elon Musk ($137.5 billion richer, 559 percent), Jeff Bezos ($65 billion, 58 percent) and Mark Zuckerberg ($47 billion, 86 percent).

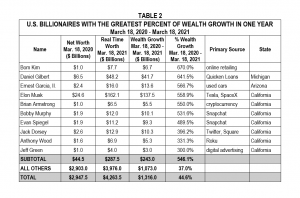

The 10 biggest “Pandemic Profiteers” saw the greatest percentage increase in their wealth—at least 300 percent. [See Table 2]

They mostly multiplied their fortunes in the world of online goods, services and entertainment, as forcibly homebound Americans shopped, invested and diverted themselves in isolation. They include the owners of ecommerce leaders Quicken Loans, Square, Carvana, and cryptocurrency exchange Coinbase; social media sites Snapchat and Twitter; online streaming platform Roku; and digital ad agency Trade Desk. 19 other billionaires experienced increases of over 200% while 48 others more than doubled their fortunes with 100%+ gains.

1. Bom Kim (670 percent/$7.7 billion): A U.S. citizen and founder of the e-commerce giant Coupang, the Amazon of South Korea. Kim’s fortune surged as high as $11 billion after the company’s IPO in early March.

2. Dan Gilbert (642 percent/$41.7 billion): Owner of Quicken Loans, which capitalized on cloistered citizens tapping online financing. Lives in Michigan.

3. Ernest Garcia II (567 percent/$13.6 billion): Biggest shareholder of Carvana, the online car sales and auto-financing giant. Arizona.

4. Elon Musk (559 percent/$137.5 billion): Musk is now the second wealthiest Americans—at nearly $138 billion—as his shares in Tesla, Space-X and other companies that he owns continue to climb. Lives in Texas.

5. Brian Armstrong (550 percent/$5.5 billion): Chief executive of Coinbase, the largest cryptocurrency exchange in the country. California resident.

6. Bobby Murphy (531 [ercent/$10.1 billion): Co-founder of Snapchat, with his Stanford fraternity brother, Evan Spiegel. California resident.

7. Evan Spiegel (490 percent/$9.3 billion): Co-founder of Snapchat with his other billionaire super-gainer, Bobby Murphy. California resident.

8. Jack Dorsey (396 percent/$10.3 billion): Co-founder and CEOs of both Twitter and Square, the small business payment app. Lives in California

9. Anthony Wood (331 percent/$5.3 billion): Founder of Roku, which enables online TV video streaming. California resident.

10. Jeff Green (300 percent/$3 billion): Californian founder and chairman of The Trade Desk, a digital advertising firm.

Other notable billionaire wealth gains during the pandemic

Eric Yuan, co-founder of video-conferencing technology Zoom, saw his wealth rise by $8.4 billion during the pandemic year, a gain of 153 percent. A year ago, Yuan had $5.5 billion which increased to $13.9 billion. Last year Zoom paid no federal income taxes on its $660 million in profits, which increased by more than 4,000 percent.

The three owners of Airbnb saw their wealth accelerate thanks to their pandemic year IPO. Brian Chesky’s wealth increased from $4.1 billion to $14.6 billion, a gain of $10.5 billion, an increase of 256 percent. Nathan Blecharazyk and Joe Gebbia, with equal ownership stakes valued at $4.1 billion a year ago, each saw their wealth increase to $13.2 billion, for gains of $9.1 billion each, or 222 percent.

Jim Koch, owner of Boston Beer Company and brewer of the Sam Adams brand, saw his wealth increase from $1.3 billion to $3.2 billion, a gain of $1.9 billion over the pandemic year, or 146 percent.

Dan and Bubba Cathy, the owners of drive-through sensation Chick-Fil-A, saw their combined wealth of $6.8 billion rise to $16.6 billion, a gain of $9.8 billion over the pandemic year, or 144 percent.

Harold Hamm, the politically connected oil and gas fracker, saw his wealth increase from $2.4 billion to $7.5 billion during the pandemic year, an increase of 5.1 billion, or 212.5 percent.

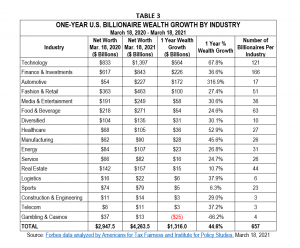

Of 17 industry categories, billionaires in the technology industry had the greatest collective wealth growth—$564 billion, or nearly 68 percent. [See Table 3]

They were worth $1.4 trillion on March 18, 2021, or one-third of the billionaires’ total. The titans of Wall Street—the Finance & Investment industries—saw their wealth grow by $226 billion—a nearly 37 percent increase. Automotive industry billionaires had the biggest percentage point increase in wealth—317 percent based on an increase in wealth of $172 billion. That was largely driven by the extraordinary rise in Elon Musk’s wealth—$137.5 billion or 559 percent.

All but three states saw the wealth of their billionaire residents increase. [See Table 4]

Topping the list in total wealth growth are California at $551 billion, Washingtonat $134.6 billion, and New York at $116.4 billion. The top three states with the greatest percentage increase in wealth are Michigan at 164 percent, Arizona at 110 percent, and Hawaii at 107 percent.

Billionaire wealth growth is calculated between March 18, 2020 and March 18, 2021, based on Forbes data compiled in this report by ATF and IPS. March 18 is used as the unofficial beginning of the crisis because by then most federal and state economic restrictions responding to the virus were in place. March 18 was also the date that Forbes picked to measure billionaire wealth for the 2020 edition of its annual billionaires’ report, which provided a baseline that ATF and IPS compare periodically with real-time data from the Forbes website. PolitiFact has favorably reviewed this methodology.